PwC Forecasts Strong DOOH Growth 2016-2020

Gail Chiasson, North American Editor

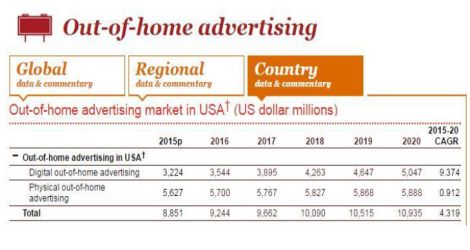

While 87.5% of the revenue growth in the US OOH market over the five years to year 2020 will come from digital, traditional formats will have only a 0.9% Compound Annual Growth Rate.

This comes from PwC, which launched its Global Entertainment and Media Outlook 2016-2020 report today (Wednesday, June 8. 2016), containing an analysis and historical/forecast data for advertising and consumer/end-user spending.

It notes that in 2015, digital formats generated revenue of US$3.22 billion. This is set to grow at a 9.4% CAGR over the next five years to reach US$5.05 billion in 2020.

This 17th edition of the Outlook was compiled by a global team involving 54 countries and covers 13 categories. It includes details on all media, with an extensive section on out-of-home media, including digital out-of-home, with part of the US section included in this article.

Chris Lederer, principal at PwC’s Strategy&, New York, was highly involved in compiling the report – Strategy& is comprised of the strategy group from PwC and that of the former Booz Allen Hamilton, purchased by PwC a year ago, Ed.

“There were two things that were ‘Aha!’ moments for us in compiling this section of the report,” says Lederer. “One was the strong digital growth compared to how flat the traditional OOH is. The other was the strength of digital penetration in some cities. It has become a lot higher in the biggest markets over the past year.

“It’s really interesting to see DOOH’s strength and how it is evolving – and it hasn’t really landed yet. We looked at full motion video, real time content, streaming social, location-based, use of data, programmatic. We noticed two operational fundamentals: DOOH’s ability to interact with its content; and that it’s now better able to measure.

“DOOH is aspirational but could be transpirational. It’s not mature yet. Data and programmatic will help the growth of networks. But programmatic won’t consume all buys. On the plus side, it will put DOOH into the full digital media mix.

“Maturity will come with more measurement and the consumer experience with digital. I think its growth will continue to accelerate.”

Following is material on the US OOH and DOOH section as provided to DailyDOOH by PwC:

The US is the world’s largest OOH advertising market, generating revenue of US$8.85 billion in 2015 – over 25% of global OOH revenue. This is forecast to grow at a healthy 4.3% Compound Annual Growth Rate (CAGR) over the next five years. In 2018, the US is expected to become the first OOH market to exceed US$10 billion in value and will reach US$10.94 billion by 2020.

The leading players in the US OOH market are major global providers Clear Channel (a subsidiary of iHeartMedia) and OUTFRONT Media (formerly CBS Outdoor), both based in the US.. and the world’s largest OOH company JCDecaux, – present, albeit with a smaller market share. Major regional players also hold large shares in certain markets, notably Fairway Outdoor Advertising and Lamar Advertising, in the Midwest and South East respectively. Lamar’s purchase of USD 800 million of assets from Clear Channel in early 2016 will substantially expand its national footprint.

JCDecaux has grown its presence in the US in recent years — one of the few major markets where it doesn’t hold a leading position — with a series of acquisitions. It has made clear its intention to expand in the US and is sure to become one of the key players in the market.

OOH advertising in the US is far more orientated towards billboards than most other mature markets. This is mainly due to the US having higher private car ownership and usage than any other major market. Nearly 70% of US OOH revenue comes from billboards (both static and digital) according to the Outdoor Advertising Association of America.

In certain locations, such as at major intersections (especially those prone to gridlock) and along busy sections of highway, billboards can be very effective revenue generators. Advertisers value the ‘big screen’ impact of billboards, especially digital billboards, in an advertising market increasingly dominated by smaller-screen mobile devices. The report says, however, that billboards are expensive to build and maintain, and reach viewers at low density with shorter viewing periods. As a result, the US has a two-speed OOH market, with the biggest cities – having both the most valuable billboard locations and the most non-billboard advertising – generating most of the national OOH revenue.

New York City is by far the most valuable OOH market in the US. As well as being by far the largest city in the country – with a metropolitan population in excess of 20 million – New York is atypical for an American city in its high density and extensive public transport network.

While 10 other American cities have some kind of metropolitan rail transit system, notably Chicago’s L and the Washington Metro, more than two-thirds of all of the US’ rapid transit ridership is in the wider New York area. As a result, with a few exceptions, transport advertising is a niche segment outside of New York. But such is the scale of New York’s rapid transit system, it alone makes up a significant portion of the US’ OOH revenue.

The New York City Subway is also at the forefront of the US’ transition to DOOH formats. The city’s Metropolitan Transportation Authority has installed digital screens throughout its network. Initially, most of these were used for customer information, but many have since been adapted or upgraded to display advertising. While DOOH displays are now ubiquitous in New York’s stations and subway platforms, most in-carriage advertising remains static. The report says that the MTA is expected to push for digitization of these displays when awarding new advertising contracts.

Outside of New York and a small number of other major cities, airports are the top source of non-billboard OOH advertising in the US. Long waiting times in airports mean that their advertising enjoys a relatively captive audience and growing adoption of DOOH in US airports is allowing for more creative and eye-catching advertisements.

This is an area where the US is particularly strong. Domestic flights are far more common in the US than any other market due to the size of the country and its airport infrastructure. While the ability to target more affluent international travelers is valued by some advertisers, the predominance of domestic traffic in US airports is more useful to brands focused on the US market.

Four of the world’s busiest ten airports are in the US — Atlanta’s Hartsfield-Jackson, Los Angeles International, Chicago O’Hare and Dallas/Fort Worth – according to Airports Council International, with a further 12 inside the top 50.

Airports are often leading the way in the adoption of DOOH – eg. JCDecaux has deployed a network of digital screens at airports including New York’s John F. Kennedy Airport and Los Angeles International, while Clear Channel has installed 76 touchscreen advertising panels at Philadelphia International.

The population density of New York, combined with its position as a major tourist destination and commercial and financial hub, makes it a highly valuable market for other forms of OOH advertising as well. The high cost of digital billboards, such as the huge Times Square installation originally developed by Clear Channel Outdoor and now owned by Silvercast Media, means they are suitable only for the densest and most lucrative locations. While New York has many such locations, outside the largest cities they are far less plentiful. The cost of digitizing billboards, the dominant format in the US, is a major part of why the country’s transition to DOOH formats is proceeding relatively slowly.

Despite being the world’s most valuable market, DOOH revenue penetration was 36.4% in 2015. While this will grow to 46.2% in 2020, by that time 15 other markets worldwide will be majority-digital.

Fortunately, the cost of the LED used in almost all digital billboards continues to fall each year, making upgrades cheaper, and thus viable in a wider range of locations. The 2013 joint venture between the City of Chicago and JCDecaux to erect 34 digital billboards along the city’s expressways is a good example of the growing reach of digital billboards.

PwC’s Outlook says that, as programmatic selling of ads makes its way to the world of OOH, a major shakeup maybe looming for the DOOH market. One of the key advantages of DOOH is that it allows for better targeting of consumers, whereas static posters are sold in blocks, DOOH displays are of course able to rotate multiple ads in such a way that each is displayed at a time of day or the week that is the most suitable to reach its target audience. This advantage has allowed the same space to be sold multiple times without diluting the value of each ad. The increased quality and prestige of digital formats, together with the knowledge that each ad will maximize its exposure to its preferred audience, is more than enough to make up for reduced display time. In this way, many DOOH displays generate upwards of 10 times more revenue than their static predecessors. However, many DOOH ads are still sometimes sold in two-to four-week blocks, just like static posters. Shifting to a more dynamic system would allow each ad to maximize its value and constitute a major leap forward for DOOH.

PwC’s notes that the next logical step in the process, already under way in some geographies is integrating Internet advertising with the DOOH market. Location-based mobile Internet advertising is booming and advertisers are increasingly interested in cross-platform campaigns that can leverage the big-screen impact of OOH. To date, this technology has focused on the Internet side, for instance serving ads related to OOH displays in the vicinity of those displays, but there is now increasing innovation moving to the OOH side.

The report says the potential entry of Google into the DOOH market would be a highly exciting but disruptive development – we seriously doubt this will happen any time soon, Ed. Google could view DOOH as a natural extension of the Internet advertising market and one could argue that in principle, there is no reason why advertising on Internet-connected public DOOH displays should function any differently to advertising on any other type of phone or computer screens. PwC do say that in practice, the technological and business barriers remain substantial, so Google’s involvement in the market is likely to remain peripheral in the short term.

In order for more dynamic programmatic applications of DOOH to fulfill their potential, better real-time viewer information is needed.

In some contexts, better information can be fed in relatively easily. For instance, many DOOH displays in airports receive data on incoming flights so as to better target those passengers. Other approaches have also been tried, such as using cameras installed on the display to guess the ages and genders of viewers.

The approach most likely to yield results is leveraging interactive elements in DOOH. Such features are already common, with games, coupons and offers being delivered to viewers’ mobile devices through quick response (QR) codes and, increasingly, near-field communication (NFC). These interactive elements have gained popularity because they help to grab and hold the viewer’s attention.

Another, less obvious but increasingly important, benefit of using interactive elements is the valuable feedback data this provides – demonstrating that the ad is being engaged with, how it is being used and even, potentially, who is using it. Connected networks of displays can enable profiles to be built up, enabling data gained from interaction with smaller displays to be fed back to non-interactive digital billboards nearby.

The increased potential for feedback and interaction is one of the key benefits of the growth of NFC payments in the US. NFC payments had struggled to gain traction for several years, but the launch of Apple Pay in late 2014 has given the market a substantial boost. NFC payment terminals are already far more widely available. The integration of NFC payments into DOOH installations, enabling them to act as points of sale, will be very attractive to certain advertisers, while simultaneously providing a vital new data stream to OOH providers.

This will make growing NFC usage one of the most important developments to watch in OOH over the next five years.

PwC’s Global Entertainment and Media Outlook 2016-2020, the 17th annual edition, contains in-depth analysis and historical and forecast data for advertising and consumer/end-user spending in 13 major industry segments across 54 countries. Segments include: Cinema, TV Advertising, TV and Video, Recorded Music, Radio, Internet Advertising (wired and mobile), Internet Access Spending (wired and mobile – communications), Video Games, Newspaper, Consumer Magazine Publishing, Consumer and Educational Book Publishing, Out of Home Advertising and Business-to-Business.

There are various subscription and single options for purchase of the report, in whole or in part. Contact pwc@materialogic.com

PwC’s accounting practice originated in London during the mid-1800’s. In 1998, Price Waterhouse and Coopers & Lybrand merged to create PricewaterhouseCoopers. PwC US is a network of firms in 157 countries with more than 208,000 people who are committed to delivering quality in assurance, advisory and tax services.

Follow DailyDOOH