The global cinema industry is set to lose USD 32bn in 2020 due to the #Covid19 pandemic, a 71.5% reduction in box office revenue compared to 2019, according to Omdia’s latest ‘Movie Windows: Adapting for the future’ report.

Maria Rua Aguete, Senior Director, Media and Entertainment at OMDIA commented: “#Covid19 also created a bottleneck of new releases which puts into question the traditional windowing model as downstream revenue sources suffer from the lack of new releases onto other platforms in 2020 and 2021. It has also created a unique opportunity for studios to experiment with other distribution models such as PVOD or and to a lesser degree straight-to-streaming without equivalent relationship damages as before. Most 2020 experimentation has not been about moving new release movies to latter windows (namely, online subscription video) sooner however, rather about creating new and temporary revenue streams to capitalize on produced content via PVOD or otherwise.”

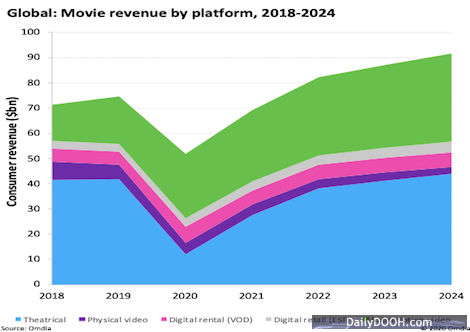

Box office revenue has dipped below USD 13bn for the first time in over two decades, forcing many studios to experiment with other platforms to account for the decline in box office revenues.

Whilst box-office revenues have been significantly hit, there has been an unprecedented growth in usage of online video (both transactional and subscription) during 2020. Online transactional and subscription video revenue is set to increase by 30% YoY from 2019 to USD 34bn in 2020.

Disney+ has trialed the use of Premium Video on Demand to launch titles such as Mulan, whilst Wonder Woman 1984 will significantly shorten its theatrical window to only one week internationally before appearing on streaming services. However, whilst this approach may satisfy consumer demand, PVOD has only accounted for a mere USD 630 million in revenues for studios in 2020.

#Covid19 has presented an opportunity for studios to experiment with alternative distribution models and identify new revenue streams such as PVOD, which may be used on selected titles and formats moving forward rather than totally replacing theatrical windows.

It has also accelerated the experimentation of the length of theatrical windows and other platform launches, many studios will still be looking towards 2021 and beyond to resume their big blockbuster cinema launches. In 2019, the US Top 10 films generate 70% of their box office takings within the first two weeks of release. This compares to 63.1% for the films ranked between 41 and 50 and 40.9% for the films between 91 and 100.

Whilst traditional theatrical windows will typically include a 90-day theatrical release window, 14-day EST period, followed by a 90-day VOD (digital rental) and physical retail, before moving to subscription services and Pay TV to maximize revenues – PVOD is a drastic move in the other direction. On the other hand, PVOD is totally reliant on the content curator decision on when and where they want to publish individual titles. For example, Disney launched Mulan directly, onto their own platform Disney+.

Omdia is a global technology research powerhouse, established following the merger of the research division of Informa Tech and the acquired IHS Markit technology research portfolio, Ovum, Heavy Reading, and Tractica.

Follow DailyDOOH